Analyst: Bitcoin Investors “Cannot Ignore” This 3-Year 70% Returns Hack

Bitcoin Investors “Cannot Ignore” This 3-Year 70% Returns Hack

Bitcoin (BTC) dollar cost averaging for even a single year is an opportunity investors “cannot ignore,†according to one of the industry’s best-known price analyst.

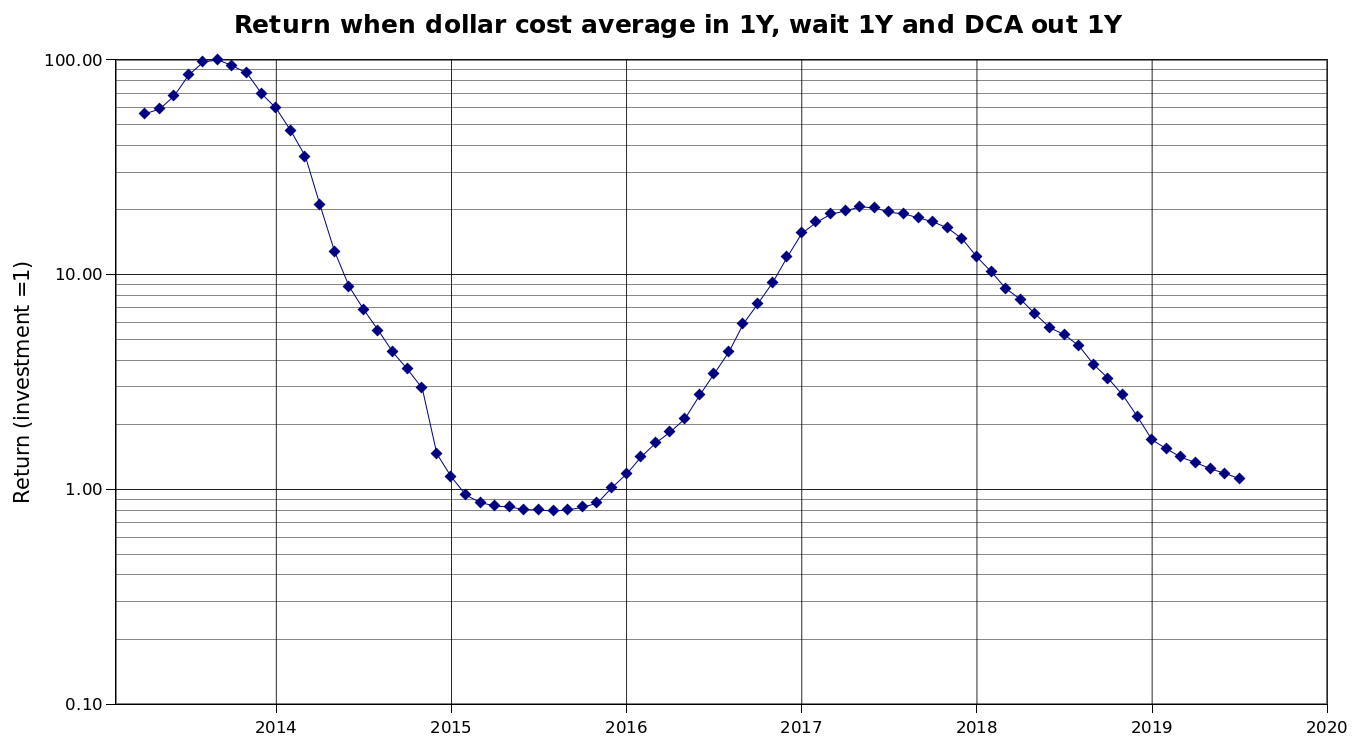

In a Twitter discussion on June 3, PlanB, creator of the widely used stock-to-flow Bitcoin price models, said that short-term dollar cost averaging (DCA) could easily garner 70% returns.

“Investors cannot ignore this”

His example covered a three-year process. Slowly increasing investment on a sliding scale through 2017, waiting all of 2018, then applying the opposite process through 2019 would have delivered returns of 70%.

“IMO investors cannot ignore this,†he summarized.

Asked whether it mattered when an investor started the process, PlanB answered that Bitcoin’s overall historical profitability meant tha the odds hardly decreased.

“It doesn’t really matter much because the (historical) odds are 9 to 1 that you earn a positive return,†he added.

Square leads DCA rush

DCA means purchasing small amounts of an asset in fixed periods of time. The aim of such an investment strategy is to avoid exposure to market swings, a conspicuous phenomenon in Bitcoin. March was the most volatile month for BTC price since January 2014, one monitoring resource notes.

Signs that investors know that they cannot ignore the idea are already seen in the wider Bitcoin space this year.

Last month payments company Square presented DCA Bitcoin buys for its users. At the time, figures from dedicated calculating resource dcaBTC suggested that $10 weekly purchasing for the past three years would have yielded 65% returns.

Alternative timeframes give similarly nice results. Quarterly returns for Bitcoin in Q2 alone have topped 50%, easily outperforming gold’s 7.2% and the S&P 500’s 20.8%.

Year-to-date, Bitcoin’s 34% returns make it the best-performing macro asset.

Despite this, overall investment volumes remain tiny compared to established asset classes, though last week’s report argues that if the current growth rate continues, Bitcoin will soon challenge the competition.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Stellar

Stellar